Foreign direct investment, institutional development, financial development and economic growth

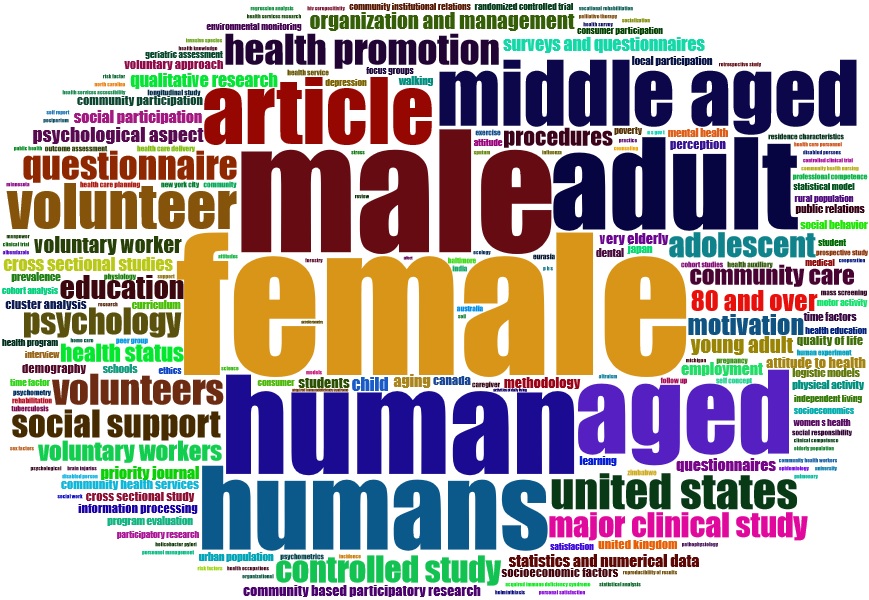

Keywords:

Foreign direct investment, financial development, economic growth, Institutional development, panel data analysisAbstract

The aim of this paper is to focus on relationship between FDI, financial development, institutional development and economic growth in North African countries from 1995 to 2017. Using the system Generalized Method of Moments (GMM) in a panel data analysis, we justify the positive effect of FDI, institutional development and financial development on the economic growth in North African countries. We also noted the important complement between FDI, institutional development and financial

Downloads

References

Azeroual, M. (2016). Investissements directs étrangers au Maroc: impact sur la productivité totale des facteurs selon le pays d’origine (1980-2012). Africa Development, 41(1), 191-213.

Bobbo, A. (2018). Volatilité de l'inflation, gouvernance et investissements directs étrangers entrants en Afrique sub‐saharienne. African Development Review, 30(1), 86-99.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The review of economic studies, 58(2), 277-297.

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of econometrics, 68(1), 29-51.

Gani, A. (2007). Governance and foreign direct investment links: evidence from panel data estimations. Applied economics letters, 14(10), 753-756.

Balasubramanyam, V. N., Salisu, M., & Sapsford, D. (1996). Foreign direct investment and growth in EP and IS countries. The economic journal, 106(434), 92-105.

Barro, R. J. (1999). Inequality, growth, and investment (No. w7038). National bureau of economic research.

Barro, R. J. & Sala-i-Martin, X. X. (1995). Technological diffusion, convergence, and growth (No. 735). Center Discussion Paper.

Breusch, T. S., & Pagan, A. R. (1980). The Lagrange multiplier test and its applications to model specification in econometrics. The review of economic studies, 47(1), 239-253.

Choong, C. K. (2012). Does domestic financial development enhance the linkages between foreign direct investment and economic growth?. Empirical Economics, 42(3), 819-834.

Findlay, R. (1978). Relative backwardness, direct foreign investment, and the transfer of technology: a simple dynamic model. The Quarterly Journal of Economics, 92(1), 1-16.

Gayle, W. (2000). Econometric Analysis. Upper Saddle River. NJ: Prentice–Hall.

Hammami, S. & Chakroun M. (2009). Gouvernance, qualité des institutions et attractivité en matière d’IDE », ResearchGate, Section Sciences Economiques. (23).2009.

Han, J. S., & Lee, J. W. (2020). Demographic change, human capital, and economic growth in Korea. Japan and the World Economy, 53, 100984.

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of econometrics, 115(1), 53-74.

Malikane, C., & Chitambara, P. (2017). Foreign direct investment, democracy and economic growth in southern Africa. African Development Review, 29(1), 92-102.

McKinnon, R. I. (2010). Money and capital in economic development. Brookings Institution Press.

Modou, D., & Liu, H. Y. (2017). The Impact of Asian Foreign Direct Investment, Trade on Africas Economic Growth. International Journal of Innovation and Economic Development, 3(1), 72-85.

North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge university press.

North, D. C. (1991). Institutions, ideology, and economic performance. Cato J., 11, 477.

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of political economy, 94(5), 1002-1037.

Peres, M., Ameer, W., & Xu, H. (2018). The impact of institutional quality on foreign direct investment inflows: evidence for developed and developing countries. Economic research-Ekonomska istraživanja, 31(1), 626-644.

Romer, P. M. (1990). Endogenous technological change. Journal of political Economy, 98(5, Part 2), S71-S102.

Sghaier, I. M., & Abida, Z. (2013). Foreign direct investment, financial development and economic growth: Empirical evidence from North African countries. Journal of International and Global Economic Studies, 6(1), 1-13.

Sghaier, I. M. (2018). Financial Development, Institutions and Economic Growth in North African Countries. Romanian Economic Journal, 20(69).

Shaw, E. S. (1973). Financial deepening in economic development.

Sokang, K. (2018). The impact of foreign direct investment on the economic growth in Cambodia: Empirical evidence. International Journal of Innovation and Economic Development, 4(5), 31-38.

Published

How to Cite

Issue

Section

Copyright (c) 2021 European journal of volunteering and community-based projects

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.